Please note

A 12% penalty will be applied to all outstanding property taxes owing February 1st.

The Municipal District of Taber collects municipal property taxes to fund various essential services, including fire and emergency services, bylaw enforcement, road construction and maintenance, mowing, tree spraying, pest and weed control, parks and recreation facilities, water, sewer, waste services, and municipal planning. Property taxes are not a fee-for-service but rather a means of equitably distributing the expenses associated with local government services and programs throughout the municipality.

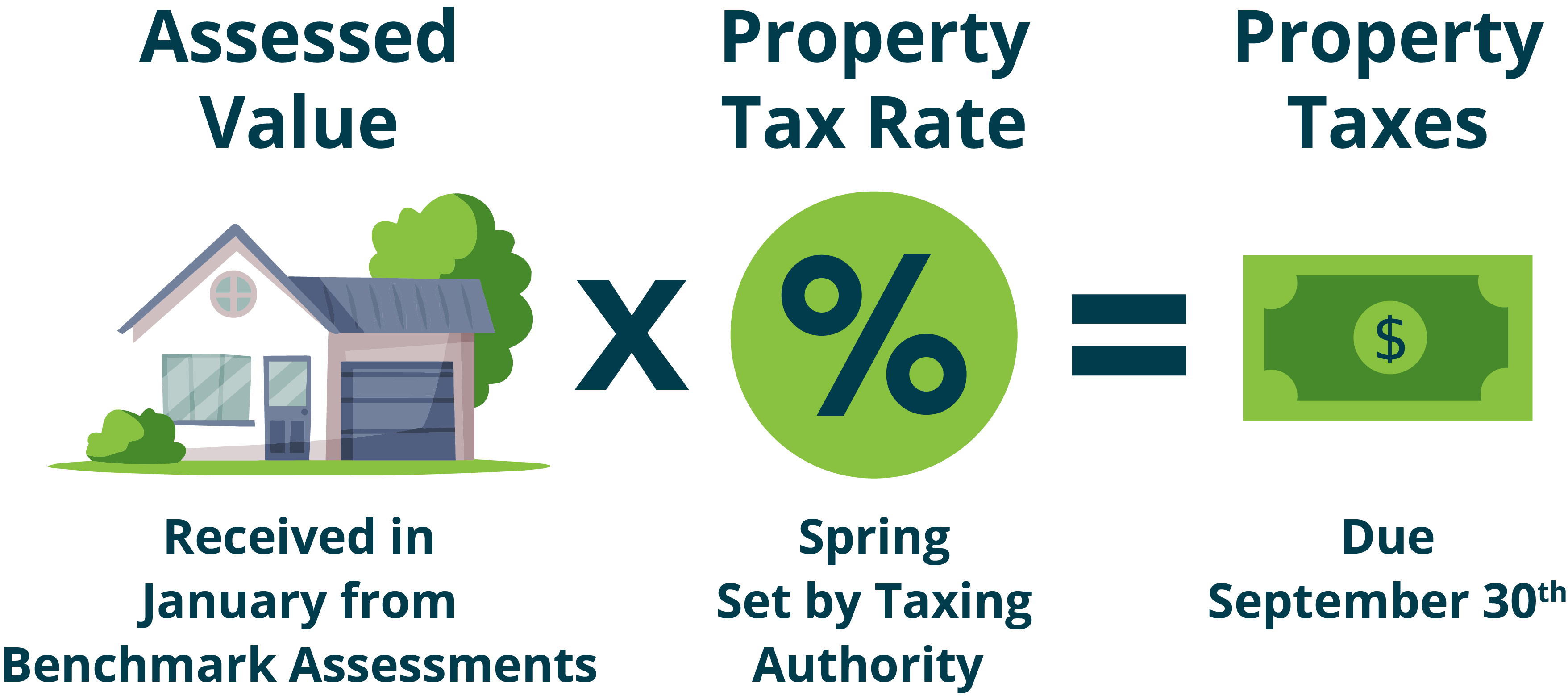

Every property undergoes a valuation process, and property taxes are calculated based on the property's assessed value. It is important to note that the terms "assessment" and "taxation" are not interchangeable.

- "Assessment" refers to the procedure of assigning a monetary value to a property for taxation purposes.

- "Taxation" involves the application of a tax rate to a property's assessed value in order to determine the amount of taxes owed and payable.

Learn more about property assessments.

Under the Municipal Government Act, municipalities are responsible for collecting taxes for not only municipal purposes but also for educational and senior housing purposes.

2024 Property Assessments Inspection Role

View the 2024 Property Assessments Inspection Role for the 2025 property pax year as per section 307 of the Municipal Government Act.

2026 Taxation Year

The following dates should be noted by all municipal ratepayers:

| February 1st | A 12% penalty is applied to all outstanding taxes |

| April 1st | Date of mailing of Annual Property Assessment Notice |

| May | Property Tax Notices are mailed |

| May 31st | Deadline for filing assessment appeals (60 days from the date of mailing assessment notices) |

| September 30th | Property taxes must be paid on or before to avoid penalties |

| October 1st | A 3% penalty is applied to current taxes owing |

| December 1st | A 3% penalty is applied to any current taxes owing |

| February 1st, 2027 | A 12% penalty is applied to all outstanding taxes |

| Questions? |

|---|

| Call 403-223-3541 Monday - Friday 8:00 am - 4:30 pm |

Expand the blue (+) tabs below for frequently asked questions.

What is a tax rate and how is it determined?

What is a tax rate?

The “mill rate” is the municipal property tax rate. The mill rate is based on "mills." It is a figure that represents the amount per $1,000 of the assessed value of the property, which is used to calculate the amount of property tax. The tax rate is the amount of tax payable per dollar of the assessed value of a property.

Each year during its annual budgetary process, Council sets the tax rate based on the total value of property within its jurisdiction to provide the necessary tax revenue to cover projected expenses – roads, water and sewer, emergency services, etc.

How is the tax rate determined?

Council determines mill rates based on the total value of property within the municipal jurisdiction, to provide the necessary tax revenue to cover projected expenses in their annual budgets.

For example, once a budget is passed by Council, known revenues are subtracted, which leaves the deficit to be raised through property taxes. This amount is divided by the value of all property in the MD, which is then multiplied by 1,000. This figure represents the tax rate.

Council approves tax rates before mid-May of each year.

How do property taxes work?

- You the ratepayer will receive a property assessment notice showing the assessed value of your property.

- You the ratepayer will receive a property tax notice for each property owned, showing how much tax is owed.

- You the ratepayer will pay the amount on your property tax notice.

- The taxes collected will fund services like snow plowing, park maintenance, emergency services, and more.

Where do my taxes go?

When you look at your tax bill, you will notice that you are paying for:

- Municipal taxes (collected by the Municipal District of Taber)

- Provincial requisitions (collected on behalf of the Province): Education Property Tax and Taber & District Housing Foundation

- Provincial policing costs (passed down from the Province)

- Recreation funding to other municipalities (passed down from the Province)

Education property tax (school tax)

The Education Property Tax is collected from all property owners in Alberta. Each year, the Municipal District of Taber receives a requisition from the Alberta School Foundation and the Holy Spirit Roman Catholic Separate District #4. The Municipality must collect and forward the requisitioned funds to the foundation. All properties are levied the education property tax (except organizations such as non-profit organizations and seniors’ lodge facilities).

Alberta’s quality education system supports and benefits all Albertans by producing the workforce of tomorrow; therefore even those without children in school pay education property tax. The Municipality cannot change the education rates or the requisition amount.

Where both a Public and a Separate School District exist in the same area, all Roman Catholic individuals must direct their taxes in support of schools to the Catholic School District. All other individuals must direct their taxes in support of schools to the Public School District. In the Municipal District of Taber, only property within the Holy Spirit Roman Catholic Separate School District No. 4 is applicable as per the Ministerial Order of the Government of Alberta. To obtain a school declaration form, please contact the Tax Clerk at the Municipal District of Taber at tax@mdtaber.ab.ca or 403-223-3541.

Other taxes

The Municipal District of Taber also receives a requisition each year from the Taber & District Housing Foundation to support affordable housing for seniors. Under the Alberta Housing Act, the Municipality is required to collect these funds from municipal property owners similar to the education requisition.

How are property taxes calculated?

Property taxes are calculated annually by multiplying the assessed value of the property by the property tax rate and dividing by one thousand.

For example: a Residential Property has a Total Assessed Value of $350,000.

$350,000 x (3.7398 ÷ 1,000) = $1,308.93

Municipal District of Taber Mill Rates – 2012 to 2025

| Year | Residential | Non-Residential | Farmland | Machinery Equipment | Small Business |

|---|---|---|---|---|---|

| 2012 | 2.6633 | 6.9632 | 6.0633 | 6.9632 | |

| 2013 | 3.4039 | 7.8579 | 6.8039 | 7.8579 | |

| 2014 | 3.4039 | 8.0084 | 6.8039 | 8.0084 | |

| 2015 | 3.4039 | 8.0084 | 7.0080 | 8.0084 | |

| 2016 | 3.4550 | 8.2084 | 7.1131 | 8.2084 | |

| 2017 | 3.5241 | 8.4547 | 7.2554 | 8.4547 | |

| 2018 | 3.6122 | 8.8379 | 7.4731 | 8.8379 | |

| 2019 | 3.7477 | 9.2135 | 7.7533 | 9.2135 | |

| 2020 | 3.8226 | 9.3978 | 8.4511 | 9.3978 | |

| 2021 | 3.8991 | 9.5858 | 9.0850 | 9.5858 | |

| 2022 | 4.0161 | 9.8734 | 9.9027 | 9.8734 | 8.886 |

| 2023 | 4.0161 | 9.8734 | 10.7939 | 9.8734 | 7.4050 |

| 2024 | 3.8555 | 9.5772 | 11.6574 | 9.5772 | 7.1829 |

| 2025 | 3.7398 | 9.5191 | 12.7066 | 9.5191 | 7.1393 |

How do I pay my property taxes?

Terms of payment

Payment must be received by the Municipal District of Taber on or before the due date to avoid penalties. Taxes levied are deemed to have been imposed for the period from January 1st to December 31st each year. Payments are applied to the oldest outstanding amount on the roll number paid.

Receipt of payment

To receive a receipt of payment for property taxes please indicate on the bottom of your remittance stub attached to your payment or contact the tax clerk at 403-223-3541 to ask for a receipt.

Receipts issued in acknowledgement of a cheque or other negotiable instrument shall be valid only when the amount of such has been collected by the Municipal District of Taber.

Making property tax payments

Businesses and individuals may pay their property taxes by one of the following methods:

Do not send cash by mail!

The Municipal District of Taber accepts postdated cheques. Property tax payments must be received by the Administration Office or delivered to Canada Post postmarked by September 15th to avoid penalties.

Online banking

Pay online through your financial institution. Please make your payment 3-5 business days before the due date to allow for processing and to avoid penalties.

- Enter ‘Municipal District of Taber' as the payee

- Enter the 'Roll Number' as the account

- If you have multiple roll numbers and want to pay your taxes online as one lump sum, enter your ID number with the number 0 at the beginning to make the account number 10 digits long

Credit card

Using your credit card, make online payments with OptionPay (service fees apply). Please indicate what roll number or ID number the payment is for. For more information about OptionPay, please call Administration at 403-223-3541.

In-person at your financial institution

Most banks and credit unions will accept payments for the Municipal District of Taber property taxes. Please make your payment 3-5 business days before November 15th to avoid penalties.

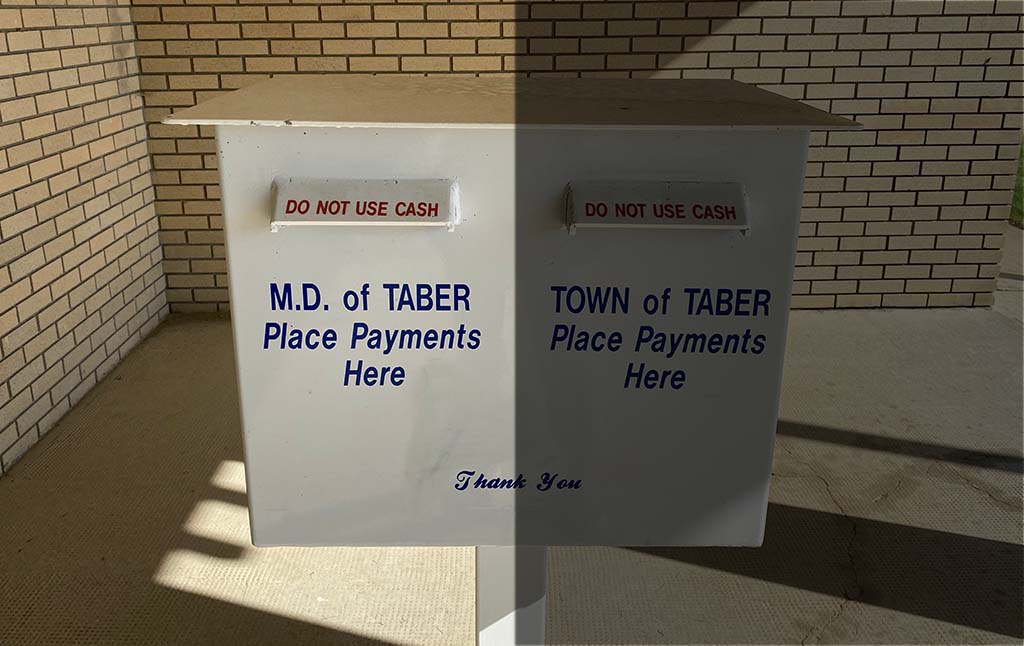

After-hours drop box

Payments may be delivered after-hours in the drop box found at the main entrance of the Municipal District of Taber Administration Building located at 4900B – 50th Street, Taber, AB.

What is the minimum property tax?

Municipalities may levy a minimum amount of property tax. The Municipal District of Taber’s 2025 Property Tax Rate Bylaw No. 2016 specifies that a minimum amount of $40.00 is payable as property tax. Any property that results in a calculated tax levy of less than $40.00 for 2023 property taxes will receive a tax notice of $40.00 owing.

What is a local improvement levy?

There may be additional charges on your Property Tax Notice for previously approved local improvements. Local Improvements include new or replacement construction projects intended to upgrade specific areas such as street paving, sidewalk replacement, or water and sewer infrastructure.

What is the senior property tax deferral program?

The Seniors Property Tax Deferral Program allows eligible senior homeowners to defer all or part of their annual residential property taxes through a low-interest home equity loan with the Government of Alberta. Download the Seniors Property Tax Deferral Program (PDF).

What is the Tax Instalment Payment Plan (TIPP)?

What is TIPP?

The Tax Instalment Payment Plan (TIPP) is a convenient monthly payment program designed to ease the burden of property tax payments. With TIPP, taxpayers have the flexibility to spread their property tax obligations evenly over the course of a year. This is achieved through automatic, pre-authorized bank withdrawals on the 15th of each month.

How does TIPP work?

Before getting started with TIPP, it's important to ensure that all previous years' taxes and penalties have been fully settled. Monthly instalments are calculated based on the prior year's tax levy, which is then divided by the number of months remaining in the current calendar year. Once the tax levy for the current year is determined, the remaining monthly instalment amounts are recalculated by dividing the outstanding taxes by the number of months left in the year.

Your tax notice will provide you with essential information, including the total payments made to date, the balance of taxes to be paid, and the new instalment amount required for the remaining monthly payments. The final payment for the year is due on December 15th.

It's worth noting that outstanding taxes for properties enrolled in the TIPP program are exempt from the 3% penalty applied to current taxes that remain unpaid after October 1st unless certain conditions specified in the Tax Penalty Bylaw No. 1985 and Agreement are not met by the taxpayer.

When can you apply?

Interested taxpayers can apply for TIPP at any time leading up to July 1st of each year. Applications submitted after July 1st will be processed for the following tax year, and the monthly instalments will commence in January.

How to apply?

To enrol in the TIPP program, you can pick up an application form at the Municipal District of Taber Administration Office or download it from the Tax Instalment Payment Plan web page. Complete the form, attach a void cheque or the Bank Information EFT Form from your financial institution, and send it to the Municipal District of Taber at 4900B 50 Street, Taber, Alberta, T1G 1T2, Attention: Tax Clerk.

Can you cancel TIPP?

Yes, you can cancel your participation in the TIPP program at any time. A written notice of cancellation must be provided, and a minimum of fifteen (15) days' notice is required. In the event of cancellation, all outstanding taxes become due and payable in accordance with the MD of Taber's Tax Penalty Bylaw No. 1985.

Experience the convenience and flexibility of the Tax Instalment Payment Plan (TIPP) to simplify your property tax payments. Apply today or reach out to us for more information.

What is a property tax bylaw?

The Municipal Government Act requires the Municipal District of Taber to pass a taxation bylaw every year. The bylaw contains the annual taxation amounts on all property types in the municipality. To view the current property taxation bylaw search our bylaws page.

What is a tax recovery process?

The Municipal District of Taber relies on the collection of property taxes to provide services, maintain infrastructure and meet our financial obligations. The Municipal Government Act section 10 provides the tax recovery process for municipalities to ensure that all businesses and individuals pay property taxes.

- If taxes are not paid by January 1st of the following year, a tax notification will be registered with the Provincial Land Titles Office against a property.

- The Provincial Land Titles Office will notify affected interest holders of the property.

- If taxes are not paid by January 1st of the second following year, the property is offered for sale by public auction no later than two years following the date of registration of the notification per Section 418(2) of the Municipal Government Act.

- If the property is sold at the public auction, the Municipality proceeds to provide a clear certificate of title to the purchasers per Section 423(1) of the Municipal Government Act.

- If the property is not sold at the public auction, the Municipality proceeds to become the owner of the property per Section 424 unless the land is undesirable for liability reasons (i.e. contaminated lands) and other alternatives will be investigated.

If the taxes, penalties, and administrative charges are paid at any time during the tax recovery process up to the date of the auction, the property can be removed from the sale.